NEED MORTGAGE

Contact us for assistance to receive a great, low rate right from the start.

CREDIT SCORE

Read For Me

The credit score is calculated by a statistical process and provides a guideline for lenders to extend credit (and if so, how much) to a borrower. Mortgage companies, banks, and insurance companies determine the interest rate they will charge based on the borrower’s credit score. The credit scoring process encompasses both your pay history and the amount of credit you currently have. The credit score is a substantial portion of the entire credit report. Low Credit Scores will result in higher payments on loans, credit cards, and insurance. The credit score is sometimes called the FICO Score. A FICO score is a credit score created by the Fair Isaac Corporation (FICO);

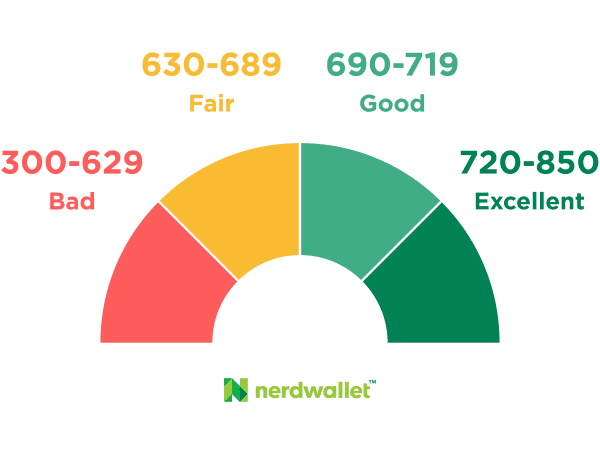

Below is a table showing different score ranges

Score Range Rating

780+ Perfect

720 – 780 Excellent

675 – 720 Average

620 – 690 Fair

Below 620 Low

Don’t assume that minor credit problems or difficulties stemming from unique circumstances, such as illness or temporary loss of income, will limit your loan choices to only high-cost lenders. If your credit report contains accurate negative information, but there are good reasons for trusting you to repay a loan, be sure to explain your situation to the lender or broker. If your credit problems cannot be explained, you will probably have to pay more than borrowers who have good credit histories. Ask how your credit history affects the price of your loan and what you would need to do to get a better price. Lenders now offer several affordable mortgage options, which can help first-time homebuyers, overcome obstacles that made purchasing a home difficult in the past. Lenders may now be able to help borrowers who don’t have a lot of money saved for the down payment and closing costs, have no or poor credit history, have quite a bit of long-term debt, or have experienced income irregularities. Some companies specialize in consumer credit repair.